International Double Taxation Portugal - update 2024

International Double Taxation Portugal - update 2024

1. FRAMEWORK

The aim of the double taxation mitigation measures is to remove barriers to cross-border investment and international trade. These measures are decisive in today's global economic environment, particularly concerning the digital economy, technological advances, increasing globalization and the free movement of people and goods within the European Union (EU). They have positive effects such as preventing tax evasion and capital flight, attracting investment, and strengthening economic and other ties between countries.

Some countries, such as Portugal, have implemented unilateral measures to mitigate international double taxation. There are also conventional measures resulting from conventions aimed at preventing double taxation, as well as harmonized measures under European law. The symbiosis of unilateral and conventional measures, within the framework of Conventions to which it has adhered, positions Portugal as an important international Investment Platform.

2. CONVENTIONS FOR THE AVOIDANCE OF DOUBLE TAXATION

Portugal, as a founding member of the Organization for Economic Cooperation and Development (OECD), has a long history and experience in concluding double taxation treaties (DTTs), primarily based on the OECD Model Convention and its various versions, with the latest dated December 18, 2017. The Portuguese tax treaty network is significant.

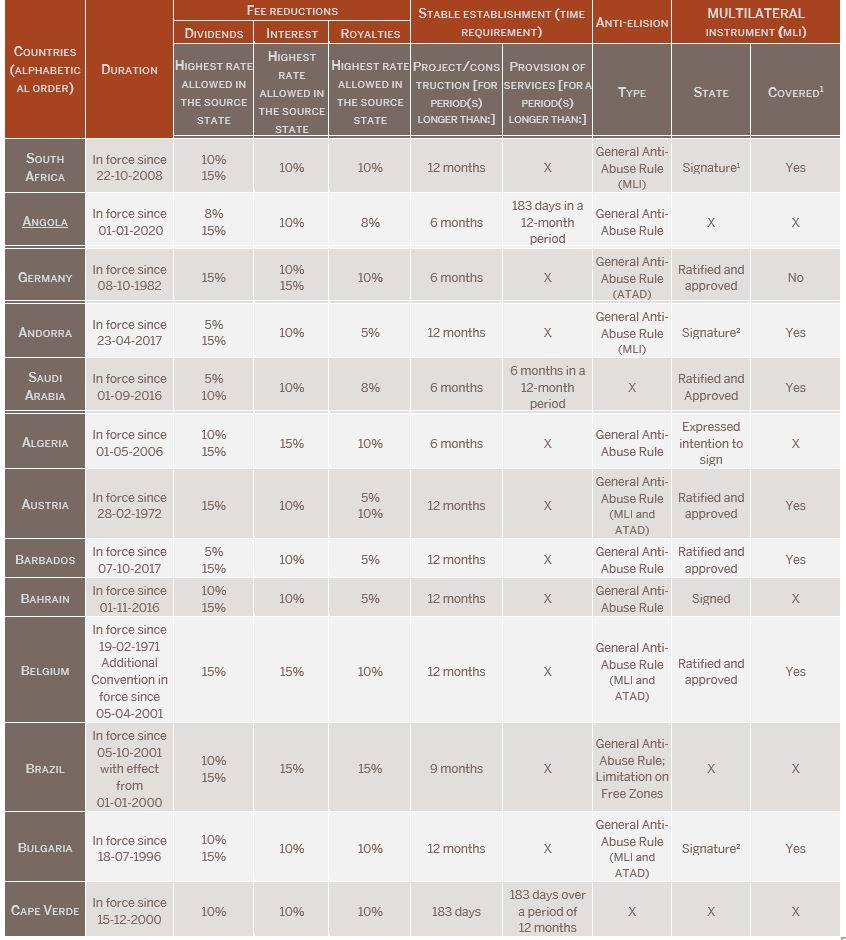

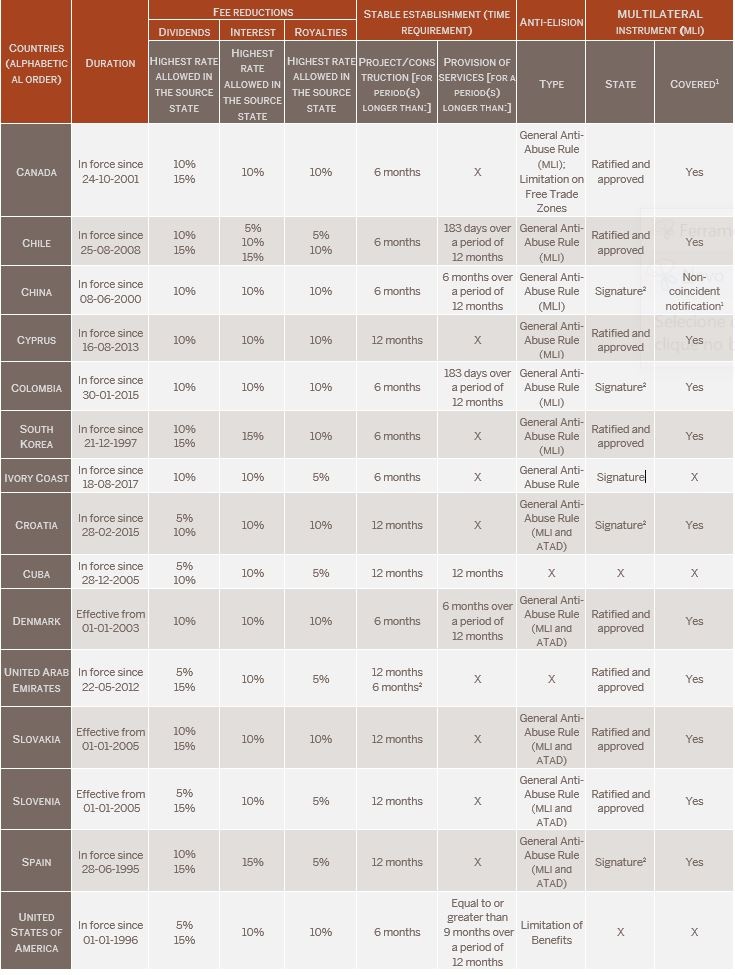

Attached is an updated Practical Table of the DTTs signed by Portugal, including an overview of their key points.

3. MULTILATERAL CONVENTION FOR THE APPLICATION OF TAX TREATY MEASURES THAT PREVENT BASE EROSION AND PROFIT SHIFTING (MULTILATERAL INSTRUMENT OR MLI)

The MLI, a key international outcome of the Base Erosion and Profit Shifting (BEPS) Project, serves as a joint reaction mechanism against certain practices that lead to erosion of the tax base and profit shifting and abusive practices.

The MLI is an almost unprecedented Multilateral Treaty at international level, designed with significant flexibility, allowing the party jurisdictions the possibility of:

- Specify the CSDs to which the MLI will apply.

- Choose from the provisions related to a minimum standard.

- Apply optional, supplementary or alternative provisions.

- Make reservations, either partially or fully excluding the application of the MLI’s provisions.

The impact of the MLI on the relations between the signatory jurisdictions depends on the positions taken by the respective states regarding the application of the Instrument. Its impact is linked to changes made to the CSDs identified by the states, sometimes influenced by the alignment of positions and reservations taken by the signatories.

One of the visible impacts, as highlighted in the Practical Table in the Annex, is the enshrinement of a general anti-abuse rule (principal purpose test) into almost all the CDTs concluded by Portugal. The table outlines the implementation and effects of the MLI for each CDT.

4. EUROPEAN UNION DIRECTIVES

Certain aspects of direct taxation, income-related, are harmonized in the EU, through a set of directives:

- Parent-Subsidiary Directive aims to eliminate international double taxation in the context of non-portfolio investments.

- Interest and Royalties Directive allows the disposal of double taxation interest and royalty payments between affiliated or co-dependent companies.

- Merger Directive seeks to remove tax obstacles to cross-border restructuring, including mergers, divisions, asset transfers and share exchanges.

- Anti-avoidance Directive (ATAD 1 and ATAD 2) harmonizes certain rules on tax avoidance, tax base erosion and profit transfer to other jurisdictions.

- Directive on the Settlement of Tax Disputes, broadens the objective and subjective scope of these disputes and aims to make the Mutual Agreement Procedure more dynamic, efficient and swift, especially in the form that admits appeal to a form of arbitration.

- Council Directive (EU) 2022/2523 of December 14, 2022, ensures a worldwide minimum level of taxation for multinational enterprise groups and large domestic groups in the Union, aiming to implement the model rules from the Tax Challenges Arising from the Digitalization of the Economy - Global Model Rules against Base Erosion (Pillar Two) (the "OECD Model Rules"), approved on December 14, 2021 by the OECD/G20 Inclusive Framework on BEPS.

- FASTER Directive (Council Directive on a swifter and more certain reduction of excess withholding tax), is currently at the second consultation stage with the European Parliament, following its approval, with amendments, by the European Council. The publication and transposition of this Directive will introduce a common EU digital tax residency certificate (eTRC). Once approved, it will enable taxpaying investors to use an eTRC to benefit from accelerated procedures for reducing withholding tax. Member States will provide an automated process for issuing digital tax residence certificates (eTRCs) to an individual or an entity that is considered resident for tax purposes, in their jurisdiction.

5. EUROPEAN UNION - FUNDAMENTAL FREEDOMS

The fundamental freedoms established in the EU Treaties are the cornerstone of the European internal market. When harmonization in direct taxation is not fully achieved, primarily due to the EU´s own limitation in this area, these fundamental freedoms, as upheld and defended in the case law of the Court of Justice of the European Union, provide, in certain cases, a new breadth in the defense of taxpayers in the field of direct taxes. This is especially relevant in removing unjustified barriers in the field of international taxation.

6. UNILATERAL MECHANISMS FOR THE ELIMINATION OF DOUBLE TAXATION

In the absence of a special agreement, such as a CDT, Portugal unilaterally reduces or eliminates international double taxation for resident taxpayers, or for non-residents through tax exemptions.

For residents, both individual and legal entities are entitled to a tax credit to mitigate international double taxation. This credit corresponds to the lower of the following amounts: the tax due in Portugal or the tax paid in the other state. In either case, the deduction of this credit will not result in a refund from the Portuguese state. For companies, the amount of this credit is determined by the country of origin of the income. Individuals may also benefits from exemptions on foreign income under schemes such as the Non-Habitual Resident (NHR) or the Incentive for Scientific Research and Development.

For non-residents, exemptions from taxation may apply to certain capital gains on securities or interest on bonds, subject to specific conditions., Exemptions from withholding tax may also be available through participation exemption mechanisms or under the Interest and Royalties Directive.

Finally, in the Madeira free zone, special rules apply to licensed or to-be-licensed companies operating under the free zone’s special regime. These rules can include exemptions on distributions to shareholders who are not tax residents in Portugal.

7. TRANSPARENCY, EXCHANGE OF INFORMATION AND TAX HAVENS

Transparency and the framework for exchanging tax and financial information have undergone significant developments, both at the European level - with the so-called DAC Directives proliferating in recent years, and the introduction of the Central Register of Beneficial Owners - and at an international level, with strengthened conventions and efforts by the OECD and the UN.

Portuguese legislation also includes a list of countries, territories or regions who clearly have a more favorable regime, based, in particular, on the following criteria: (i) the absence of a tax similar to the IRC or a tax with a rate lower than 60% of the normal IRC rate; (ii) Significant differences in the determination of the tax base from internationally accepted standards; (iii) special tax regimes that provide for a substantial reduction in taxation; (iv) the failure to provide or effectively exchange relevant information for tax purposes.

The list of designated tax havens is approved by Ministerial Order, following a prior opinion from the tax authorities. This list is local and independent of the European Union list of non-cooperative jurisdictions for tax purposes.

PRACTICAL TABLE OF DOUBLE TAXATION AVOIDANCE CONVENTIONS CONCLUDED BY PORTUGAL

***

Rogério Fernandes Ferreira

Marta Machado de Almeida

Álvaro Silveira de Meneses

Miriam Campos Dionísio

João de Freitas Jacob

José Nuno Vilaça

Joana Fidalgo Barreiro