2024 Personal Tax Filing Season for 2025

2024 Personal Tax Filing Season for 2025

In Portugal, the tax filing period for individuals, which pertains to the obligation of submitting the annual Form 3 tax return (Modelo 3 de IRS), spans from 1 April until 30 June of the year following the one to which the income pertains. In this newsletter, we outline the key highlights and primary considerations that taxpayers should be aware of when filing their Portuguese tax returns. Additionally, the lawyers at RFF Lawyers are available to assist taxpayers in fulfilling this obligation.

TAX RESIDENCY AND TAXATION IN PORTUGAL

In Portugal, income earned by natural persons is subject to personal income tax (IRS).

If a taxpayer is considered to be tax resident in Portugal - this includes those who are covered by the Non-Habitual Residents (NHR) regime and the Tax Incentive for Scientific Research and Innovation (IFICI) regime - as the country of tax residence, Portugal will levy IRS on the worldwide income, which must be reported in the taxpayer's annual income tax return (Declaração Modelo 3 de IRS).

Taxpayers who are residents in Portugal (and, once again, this includes NHRs and IFICI beneficiaries) are also obliged to declare all their foreign bank accounts by indicating the IBAN and BIC/Swift codes, even if they have not generated any income.

On the other hand, if taxpayers qualify as non-residents, Portugal will only be entitled to tax income from Portuguese sources for IRS purposes, and only this income is subject to reporting obligations.

In either case, the personal income tax return must be submitted electronically via the Tax Authority's website (Portal das Finanças) between 1 April 30 June of the year following the on to which the income to be declared relates. Taxpayers must have a password to access the Portal das Finanças, which they should already have or which should be requested as soon as possible, but always before the period for completing and submitting the IRS Model 3 declaration.

Bearing this in mind and considering that in Portugal the tax year coincides with the calendar year (i.e. it runs from 1 January to 31 December) if, for example, a non-resident receives rental income from a Portuguese source during the 2024 tax year, they will have to submit a Model 3 IRS declaration between April and June of 2025, reporting this income to the Portuguese Tax Authorities.

On the other hand, and still in this regard, it is important to note that, in a given tax year, an individual may be considered partially resident in Portugal. Thus, for example, if a taxpayer is considered a tax resident in Portugal between January and June of a given year, and a non-resident between July and December of the same year, that taxpayer will have to declare, in Portugal, their worldwide income earned between January and June of that year, and only declare their Portuguese source income earned between July and December of that year (which means, in practical terms, that you may have to submit two distinct Model 3 IRS returns, despite pertaining to the same tax year).

THE IMPORTANCE OF PROPER INCOME QUALIFICATION

Pursuant to the applicable legislation, income earned by individuals is subject to taxation under the following IRS categories:

- Category A - income from employment income

- Category B - business and professional income

- Category E - investment income (e.g. dividends and interest)

- Category F - rental income

- Category G - movable and immovable capital gains

- Category H - pension income

Each of these categories has a specific method of taxation and may be subject to different tax rates. It should be noted that the Portuguese State Budget for 2023 introduced the new tax framework applicable to gains derived from crypto assets, including the sale of assets and the issue of assets or validation of transactions through consensus mechanisms.

Regarding the NHR special taxation regime, it is important to note that this regime grants three main benefits, briefly described as follows:

- Firstly, NHR taxpayers who carry out activities considered to be of high added value (as outlined within the Ordinance approved by the Portuguese government) can benefit from a special flat rate of 20%, applicable to employment income (category A) and business or professional income (category B)

- Secondly, the NHR taxpayer can also benefit from a flat rate of 10% applicable to pension income from a foreign source (category H)

- Thirdly, regarding other foreign sourced income, the NHR taxpayer may benefit, in certain circumstances, from the application of the exemption method (instead of the tax credit method) as the standard method for the elimination of double taxation of their income

The application of the flat rates of 20% or 10% or the exemption method to foreign sourced income depends, first and foremost, on the correct classification of the income considering the Portuguese legislation in force, as well as the applicable Double Tax Treaties, and is contingent upon the accurate classification of the income when completing the IRS tax return.

Regarding the IFICI special tax regime, the main benefits are as follows:

- • Taxation at a flat rate of 20% applicable to employment income (category A) and business or professional income (category B) earned within the scope of the activities covered by the regime

- • Benefiting from the application of the exemption method as the standard method for the elimination of double taxation of their foreign source income relating to all categories of income except category H (pensions)

In fact, the accurate classification and reporting of income is crucial for taxpayers to fully benefit from the advantages afforded to those with special status under the NHR or IFICI regimes. In the specific case of IFICI beneficiaries, given that 2024 marks the inaugural year of the regime's application, particular diligence and attention to detail are required in the reporting process and the subsequent monitoring of the assessment issued by the tax authorities, as the potential for system errors is not insignificant.

Incorrect classification or categorization of the income type earned by the taxpayer may result in the inaccurate completion of the income tax return, which could, in turn, lead to an increased tax liability compared to the amount that would have been due had the return been correctly filed.

On the other hand, if the incorrect completion of the tax return results in the payment of less tax than would otherwise be due, the tax authorities may initiate a subsequent ex-officio correction and may ultimately impose a penalty and interest for late payment (for the inaccurate filing of the tax return and for the delay in remitting the outstanding tax liability, respectively).

TAX-DEDUCTIBLE EXPENDITURES

In order to ensure that the taxpayer is able to deduct all eligible expenses for the purposes of calculating the tax liability, it is essential for the taxpayer to request the inclusion of their tax number identification (NIF) on the invoice issued for each purchase of goods and services.

In addition, for these invoices to be considered, the taxpayer must subsequently validate them, bearing the responsibility to ensure they have been correctly issued by the service provider or seller of the goods. This procedure entails validating the invoices through the Tax Administration's designated platform for this purpose (e-Fatura), and it is necessary to allocate each of these expenses to the corresponding category below:

- General and family expenses

- Health and health insurance expenses

- Expenses with fitness gyms

- Education and professional training expenses

- Property costs

- Elderly care home fees

- Car repair costs

- Motorcycle repair costs

- Catering and accommodation costs

- Hairdressers and beauty parlours costs

- Veterinary expenses

- Monthly public transport passes expenses

- Newspapers and magazines expenses

It should be noted that this information must be communicated until 25 February of the year following the one to which the expense relates. In other words, for the expenses incurred in 2024 to be deducted from the taxpayer's personal income tax, the taxpayer must confirm the invoices on the e-Fatura website until 25 February, and the submission of the Model 3 tax return must take place between April and June of 2025.

In any case, it should be noted that it is still possible to change the values of invoices communicated via the e-Fatura website when filling in the personal income tax return, which means that in this case the respective amounts will have to be entered manually.

In such situations, the amounts declared by the taxpayer to the tax authorities when filling in the tax return replace any amounts that had been previously communicated, and any amounts exceeding those previously registered must be justified by the taxpayer afterwards.

COMMON REPORTING STANDARD (CRS) RULES

Finally, with respect to the completion of the IRS tax return, it is important to highlight the existence of international information exchange mechanisms, such as the Common Reporting Standard and the standard for the automatic exchange of financial account information. These frameworks facilitate the automatic exchange of tax data between tax authorities from different countries concerning specific events or income, and they are fully implemented.

According to these rules, banking institutions report certain types of payments and financial movements related to taxpayers' bank accounts and/or other financial instruments held by the taxpayers to the tax authorities in their countries:

- interest, dividends and other capital income

- Capital gains derived from the sale of financial assets

- Bank account balances at the beginning and end of each year

- Balance of life insurance policies

The information exchanged relates to accounts held by individuals who reside in any member state of such an agreement, under the terms of that state's tax legislation.

This implies, for example, that foreign-source interest received by tax residents in Portugal is reported to the Portuguese tax authorities by their counterpart. We emphasise that this mechanism also makes it imperative to report all bank accounts held abroad.

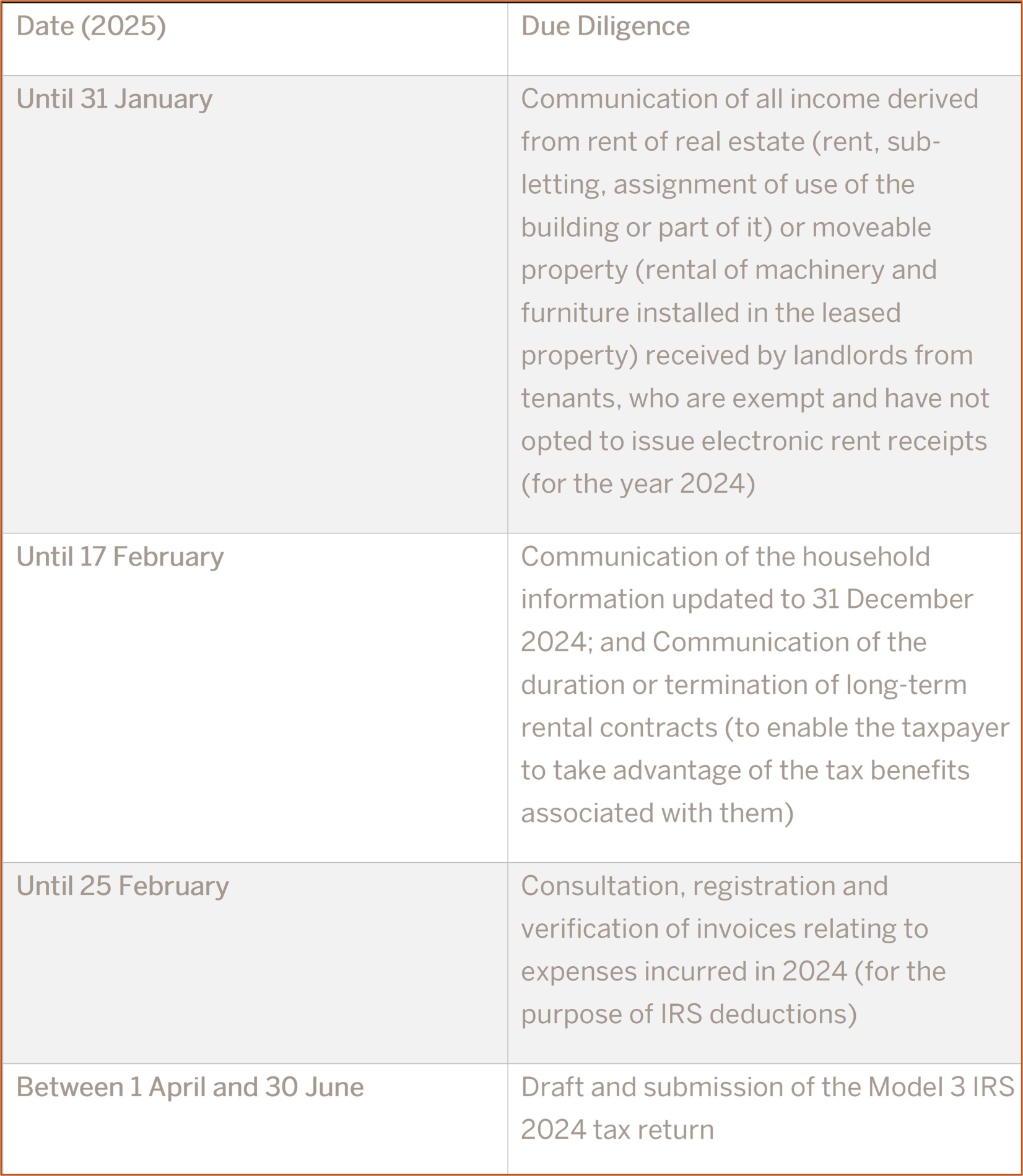

TIMELINE OF THE TAX SEASON 2024-2025

The tax authorities have provided a timeline for the fulfilment of due diligence in the process of filing and submitting the 2024 IRS Model 3 tax return, as shown below:

CONCLUSIONS

Regardless of the legal and tax status of the individual, whether resident or non-resident in Portugal, the classification of their income can be complex, and the use of specialised advice and assistance is advisable.

In fact, the correct and exact classification of income and its correct and timely indication in the IRS Model 3 declaration is of the utmost importance to guarantee fair and adequate taxation, which means that the IRS Model 3 declaration must be filled in properly and correctly.

A final note on an amendment to the Personal Income Tax Code (added by Law 82/2023 of 29 December), which provides for the need to report in the Model 3 tax return assets held in countries, territories or regions with a clearly more favourable tax regime as well as crypto assets. This legal rule was not applied during last year's tax return season as it was not possible to implement these changes in the tax authorities' informatic system in good time. Nevertheless, after much discussion about the legal rule's merits, the need to report these assets has now been confirmed.

***

Rogério Fernandes Ferreira

Duarte Ornelas Monteiro

Joana Marques Alves

Ana Sofia Gariso

Amélia Carvela

João Aguiar Câmara

Inês Marques Dias

João Rebelo Maltez

Henrique Guia Rebola

Nicolas Corrêa Simonini